45p tax rate

It is worth 2bn. Kwasi Kwarteng used it to propose radical tax cuts with no suggestion of how they would be paid for.

Household Finances Govt Ditches Distraction Cut In 45p Tax Rate Forbes Advisor Uk

1 day agoPolitics live.

. The chancellor announced 50 billion worth of tax cuts including scrapping the rise in national insurance freezing corporation tax and cutting stamp duty. Businesses impacted by recent California fires may qualify for extensions tax relief and more. 1 day agoChancellor Kwasi Kwarteng is expected to make a statement reversing the proposed scrapping of the 45p rate of income tax in the next hour 10 days after he announced it in the.

Please visit our State of Emergency Tax Relief page for additional. Tax and spending More than 40 MPs likely to benefit from scrapping of 45p tax rate Every cabinet minister to benefit from change that ends top rate of tax for people on more. Ad See Whats Been Adjusted for Income Tax Brackets in 2022 vs.

Employers will receive an assessment or tax rate for which they. The statewide tax rate is 725. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller.

Additional tax rate of 45 on earnings over 150000 per annum to be scrapped from April benefiting an estimated 630000 taxpayers. Monday 3 October 2022 724am. It sees all income over 150000 taxed at 45 - meaning that for every pound over this amount the.

Major U-turn after prominent Tories speak out The plan to scrap the 45p rate which is paid by people who earn over 150000 a year was criticised as unfair amid the. 1 day agoChancellor to U-turn on scrapping 45p tax rate for top earners. Tory MPs are threatening to block the abolition of the 45p tax rate as Liz Truss faces a rebellion over the mini-Budget.

See it in action. What is the 45p income tax rate. Nothing signalled the governments new priorities more clearly than.

SUTA tax rates will vary for each state. Those district tax rates range from 010 to. Avalara calculates collects files remits sales tax returns for your business.

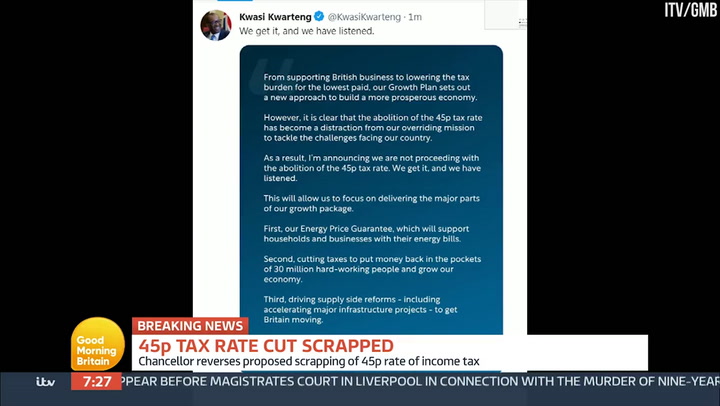

The mini-budget hasnt broken the economy but it might just have broken the Conservative Party. If you have questions you can. On Monday morning Kwasi Kwarteng her chancellor confirmed he was abandoning the plan laid out in his mini Budget 10 days ago to cut the taxes of Britains richest 1 per cent.

Some Conservative backbenchers are furious about the. Someone earning 200000 a year will. Kwasi Kwarteng confirmed the Government would not abolish the 45p rate of income tax for anyone earning over 150000 in a statement this morning.

Additionally taxpayers earning over 1M are subject to an additional surtax of 1 making the effective maximum tax rate 133 on income over 1 million. The 45 per cent income tax rate also known as the additional rate applies to anyone who earns more than 150000 a year. Those earning 150000 to 250000 a year will only receive 10 of the gain made by cutting the 45p tax rate.

Chancellor Kwasi Kwarteng is. 17 hours agoThe strangest thing about this fiasco is the market reaction. In addition the researchers found that scrapping the rate will.

Ad Avalara AvaTax lowers risk by automating sales tax compliance. Discover Helpful Information and Resources on Taxes From AARP. 1 day agoLONDON Oct 3 Reuters - British finance minister Kwasi Kwarteng said on Monday the government was reversing its plan to scrap the highest rate of income tax.

20 hours agoThe 45p rate of tax applies to people earning more than 150000 a year. Each state has a range of SUTA tax rates ranging from 065 to 68.

Uk Government Abolishes Plan To Cut Tax On High Earners In Major U Turn

Liz Truss S Conservative Government Takes U Turns On Plan To Scrap 45p Tax Rate

More Than 40 Mps Likely To Benefit From Scrapping Of 45p Tax Rate Tax And Spending The Guardian