pay indiana business taxes online

If needed please read these handy step-by-step guides. The self-employment tax is a social security and Medicare tax for individuals who work for themselves.

Corporate Tax Rates By State Where To Start A Business

Indiana Small Business Development Center.

. Indianas one-stop resource for registering and managing your business and ensuring it complies with state laws and regulations. Please contact us at 8008916499 and request a Tax Liability Status Auditor if you have an account in pending status. Your business may be required to file information returns to report.

The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business taxes withholding. Articles of Amendment - used to change information such as business name number of shares. The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business taxes withholding.

Paying by e-check should notify their banking institution that. You will need to either have or create a login to access the payment plan functions on INTIME. Indiana businesses have to pay taxes at the state and federal levels.

INBiz can help you manage business tax obligations for Indiana retail sales withholding out-of-state sales. If the due date falls on a national or state holiday Saturday or Sunday then payment should be made online or postmarked by the next business day. Create an INTIME Logon.

Any employees will also. INtax is Indianas free online tool to manage business tax obligations for Indiana retail sales withholding out-of-state sales and more. County Rates Available Online.

SBAgovs Business Licenses and Permits Search. Here are some examples of filings available to update your business information. Your browser appears to have cookies disabled.

DOR Tax Forms Online access to download and. Indiana Business Taxes for LLCs. Prepare to file and pay your Indiana business taxes You can file and pay with the Indiana DOR online using the Indiana Taxpayer Information Management Engine INTIME.

Business taxes are a fact of life and your LLC will need to pay a variety of taxes to both the state and federal governments. The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically using DORs e-services portal. Department of Administration - Procurement Division.

Depending on the amount of tax you. Cookies are required to use this site. Estimated tax installment payments.

All businesses in Indiana must file and pay their sales. You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2165 or visiting wwwintaxpayingov. Indiana county resident and nonresident income tax rates are available via Department Notice 1.

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Ebay Or Etsy Sale Of 600 Now Prompt An Irs Form 1099 K Money

Guide And Calculator 2022 Indiana Sales Tax Taxjar

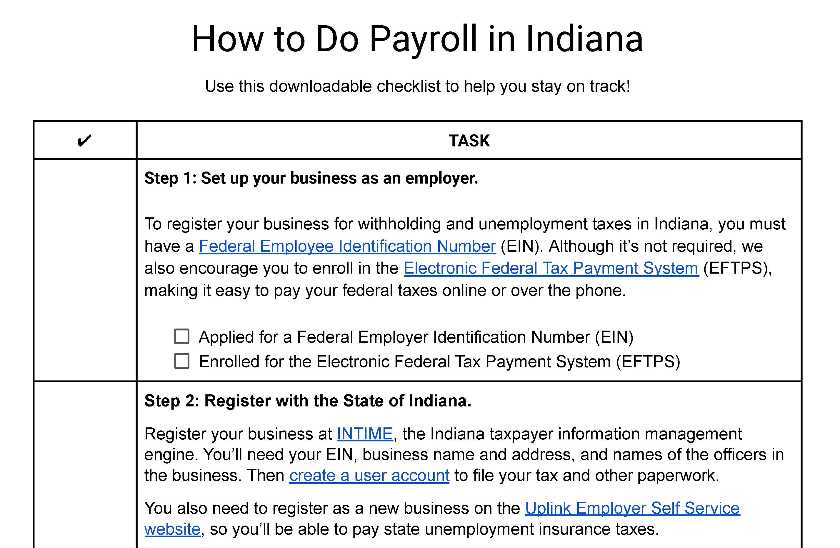

How To Do Payroll In Indiana What Every Employer Needs To Know

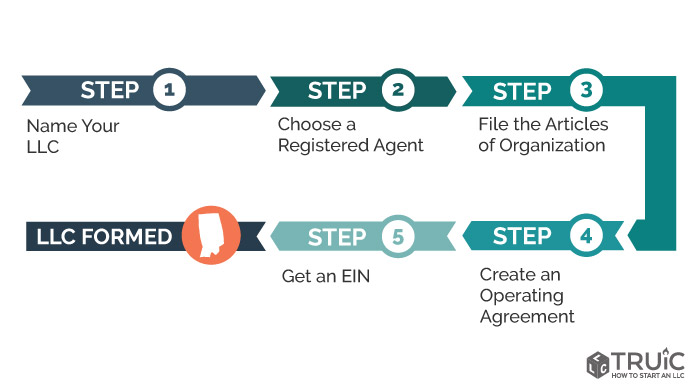

Llc Indiana How To Start An Llc In Indiana Truic

Indiana State Tax Information Support

How To Pay Illinois Sales Tax Online 9 Steps With Pictures

How To Pay Sales Tax For Small Business 6 Step Guide Chart

How To Get A Sales Tax Exemption Certificate In Indiana Startingyourbusiness Com

Oops Here S What To Do If You Missed The Tax Deadline

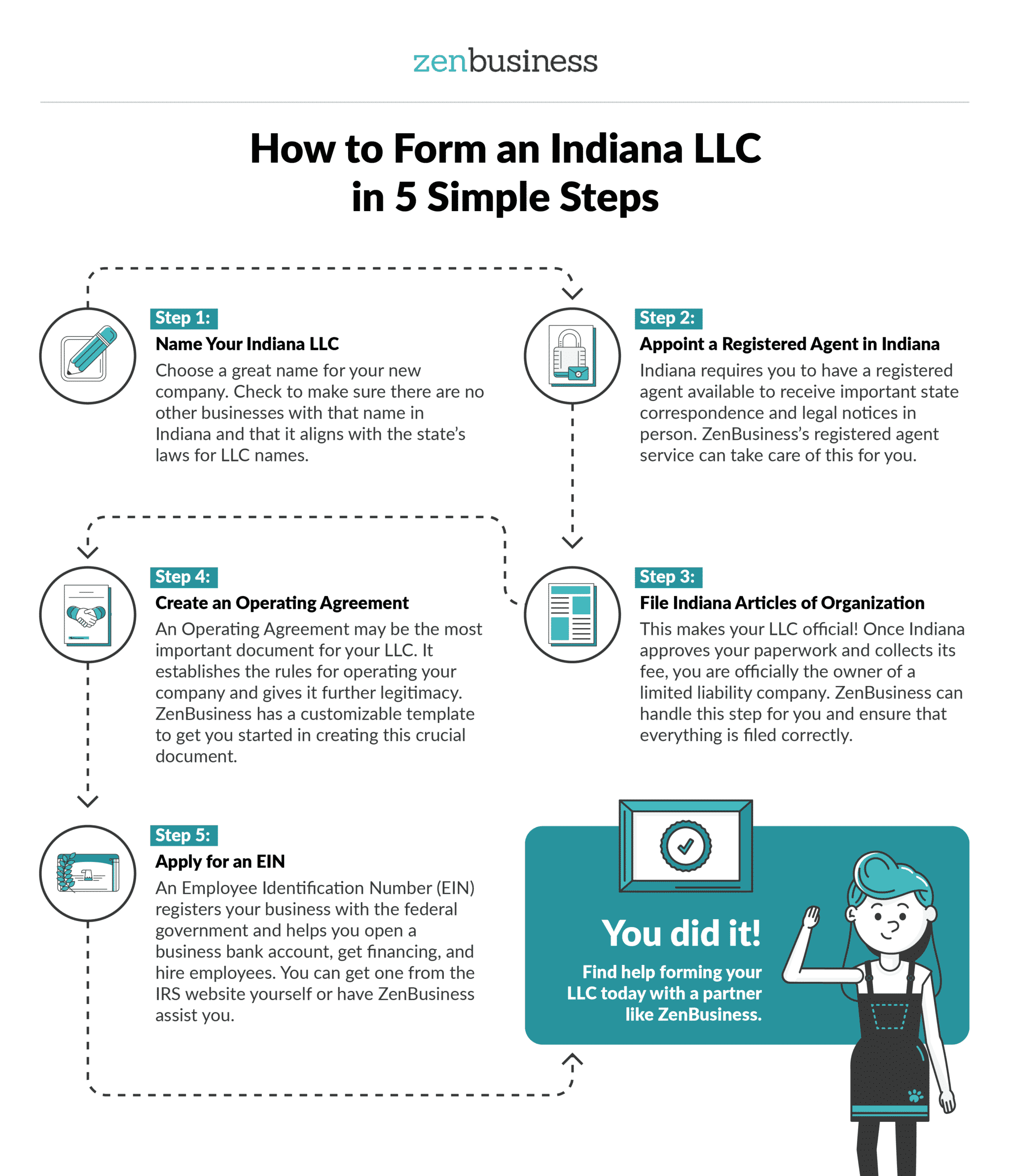

How To Start An Llc In Indiana For 49 In Llc Application Zenbusiness Inc

Indiana Sales Tax Small Business Guide Truic

Tax Credit Online Marketplace Creates Connections For More Deals Inside Indiana Business

Do You Have To Pay Sales Tax On Internet Purchases Findlaw

Indiana Business Personal Property Taxes Guide

Business Income Taxes In Indiana Who Pays

Indiana Tax Refund Here S When You Can Expect To Receive Yours